First-time homebuyers face the greatest challenge, as they must factor rising insurance costs into already stretched budgets. With median home prices in metro Atlanta at $397,948 and requiring 34.7% of median household income for monthly payments, additional insurance costs create another barrier to homeownership4.

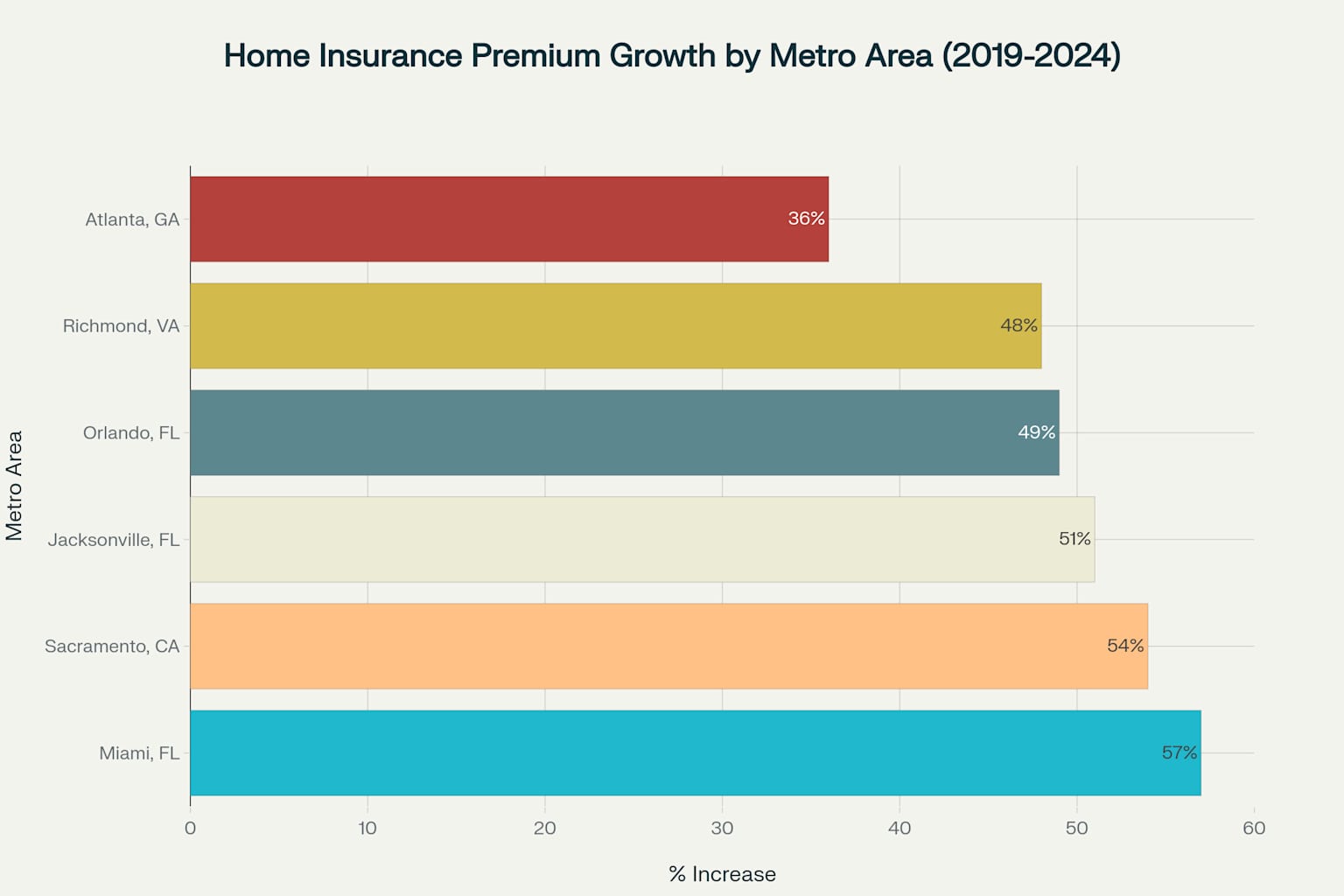

Existing homeowners on fixed incomes, particularly retirees, face ongoing pressure as their insurance costs continue to rise faster than their income growth. The Atlanta area has seen insurance premiums increase by an average of 48% since 2019, adding significant annual costs to homeownership15.

Mortgage Market ChallengesSome relief may be available through specialized programs like Georgia Dream mortgages, which offer rates of 5.875% for qualified buyers18. Additionally, assumable mortgage programs are gaining traction, allowing buyers to take over existing low-rate mortgages, though these opportunities are limited19.

Affordable Housing ImpactHowever, Atlanta's housing market shows resilience with significant inventory available. Current data shows 3,802 affordable homes listed in Atlanta at a median price of $375,000, with over 700 homes available under $200,0002021. The city maintains numerous affordable housing programs through Atlanta Housing and other agencies, serving over 90 apartment communities throughout the city22.

Regional Comparison and Market PositionEconomic Impact and Future Outlook

Despite these challenges, Atlanta maintains relative affordability compared to other major metros and continues to offer significant housing inventory and assistance programs. However, the trajectory of increasing climate risks and insurance costs suggests that addressing these challenges will require ongoing attention from policymakers, insurers, and community leaders to maintain the region's position as an accessible housing market.